supported by the Michigan State Credit Union League

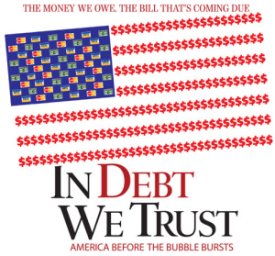

Powerful new documentary on consumer credit/debt by Danny Schechter and featuring Dr. Robert D.

Manning.

Powerful new documentary on consumer credit/debt by Danny Schechter and featuring Dr. Robert D.

Manning.

Dr. Manning announces new "History of Saving in America" project. Includes opportunity to acquire historic World War I and World War II

saving bond posters.

Join the Ben Franklin saving club and have FUN! Dr. Manning is working on a documentary, museum exhibitions, and war bond poster and antique saving bank

campaign. Save American history and enjoy the beauty of original and rapidly appreciating War Bond posters and vintage banks. Dr. Manning is collaborating with

major collectors to enable you to purchase authenticated, historic posters of our nation's commitment to saving and recycling. Learn more...

DVD Now Available!

FINALIST for 2007 HARRY CHAPIN MEDIA AWARD

Since Dr. Manning's October 2005 press conference, he has accurately predicted the collapse of the housing bubble in 2006 and the consumer-led recession in

summer 2008. Dr. Manning forecasts three phases of the 2008 recession: (1) consumer debt stress, (2) job/income loss, and (3) international investment pressure.

He expects that the second phase of the subprime mortgage crisis will continue to impact the US housing market through the beginning of 2010. View the entire press release

Dr.

Robert D. Manning is the author and inspiration of Credit Card Nation which has influenced public policy and research on consumer

credit in the United States and abroad. Dr. Robert Manning has contributed to state and federal legislation concerning the marketing of credit cards to college students, consumer bankruptcy reform, predatory loans, and financial

education programs. Dr.

Robert D. Manning is the author and inspiration of Credit Card Nation which has influenced public policy and research on consumer

credit in the United States and abroad. Dr. Robert Manning has contributed to state and federal legislation concerning the marketing of credit cards to college students, consumer bankruptcy reform, predatory loans, and financial

education programs.

A podcast interview with Dr. Manning about college students and

credit cards

Dr. Manning's TOP TEN TIPS [pdf] of the Credit Card Nation

Newtonian Finances has partnered with Careerbuilder.com for employment related services (free and for

fee) and Cardratings.com for selecting personal credit cards (free services)

Ralph Nader delivered the inaugural address for the Center

for the Study of Consumer Financial Services (CSCFS) [Real Media Stream] at Rochester Institute of Technology on March 21, 2006.

Dr. Manning is the founding director of CSCFS and the new Consumer Financial Services undergraduate program at RIT. Ralph Nader delivered the inaugural address for the Center

for the Study of Consumer Financial Services (CSCFS) [Real Media Stream] at Rochester Institute of Technology on March 21, 2006.

Dr. Manning is the founding director of CSCFS and the new Consumer Financial Services undergraduate program at RIT.

Dr. Manning's discusses predatory lending and

banking deregulation on the Al Franken Show (AIR AMERICA Radio Network) on Thursday, April 27th. Dr. Manning's discusses predatory lending and

banking deregulation on the Al Franken Show (AIR AMERICA Radio Network) on Thursday, April 27th.

See Dr.

Manning on The Daily Show with Jon Stewart where he discusses marketing credit cards

to college students during springbreak. View the "Beach

Ploys" segment online! See Dr.

Manning on The Daily Show with Jon Stewart where he discusses marketing credit cards

to college students during springbreak. View the "Beach

Ploys" segment online!

Click

here for info on viewing your credit report for free. Click

here for info on viewing your credit report for free.

Consumer Bankruptcies soared to 2 million in

2005 following the enactment of the Bankruptcy Abuse Prevention and

Consumer Protection Act of 2005. Dr. Manning, who testified against the legislation in the U.S. Senate Judiciary hearing in February 2001 and a

U.S. Congressional policy briefing in May 2006, emphasizes that it not only threatens American's consitutional right of filing for

personal bankruptcy protection but it is a hollow victory for the financial services industry since it will

not deliver significantly greater payments to unsecured creditors. In his forthcoming book, GIVE YOURSELF CREDIT, Dr. Manning explains the

implications of the new law to financially distressed consumers. Furthermore, major changes in

the Consumer Credit Counseling Services (CCCS) is occuring as the IRS is rejecting nonprofit status to many creditor financed "nonprofits" as well as

nonprofit counseling organizations associated with for-profit debt consolidation and debt relief programs. See IRS rulings while Module 12 is being revised. Click here for information on how to file for bankruptcy in your specific state. Consumer Bankruptcies soared to 2 million in

2005 following the enactment of the Bankruptcy Abuse Prevention and

Consumer Protection Act of 2005. Dr. Manning, who testified against the legislation in the U.S. Senate Judiciary hearing in February 2001 and a

U.S. Congressional policy briefing in May 2006, emphasizes that it not only threatens American's consitutional right of filing for

personal bankruptcy protection but it is a hollow victory for the financial services industry since it will

not deliver significantly greater payments to unsecured creditors. In his forthcoming book, GIVE YOURSELF CREDIT, Dr. Manning explains the

implications of the new law to financially distressed consumers. Furthermore, major changes in

the Consumer Credit Counseling Services (CCCS) is occuring as the IRS is rejecting nonprofit status to many creditor financed "nonprofits" as well as

nonprofit counseling organizations associated with for-profit debt consolidation and debt relief programs. See IRS rulings while Module 12 is being revised. Click here for information on how to file for bankruptcy in your specific state.

Copyright Newtonian Finances Ltd. © 2000-2024 (disclaimer) |

|

Dr.

Robert D. Manning

Dr.

Robert D. Manning Ralph Nader delivered the

Ralph Nader delivered the  Dr. Manning's

Dr. Manning's

See Dr.

Manning on

See Dr.

Manning on